ANZ and Chainlink Collaboration Pioneers Cross-Chain Settlement of Tokenized Assets on Avalanche and Ethereum

TLDR:

- ANZ and Chainlink collaborate to explore cross-chain settlement of tokenized assets on Avalanche and Ethereum.

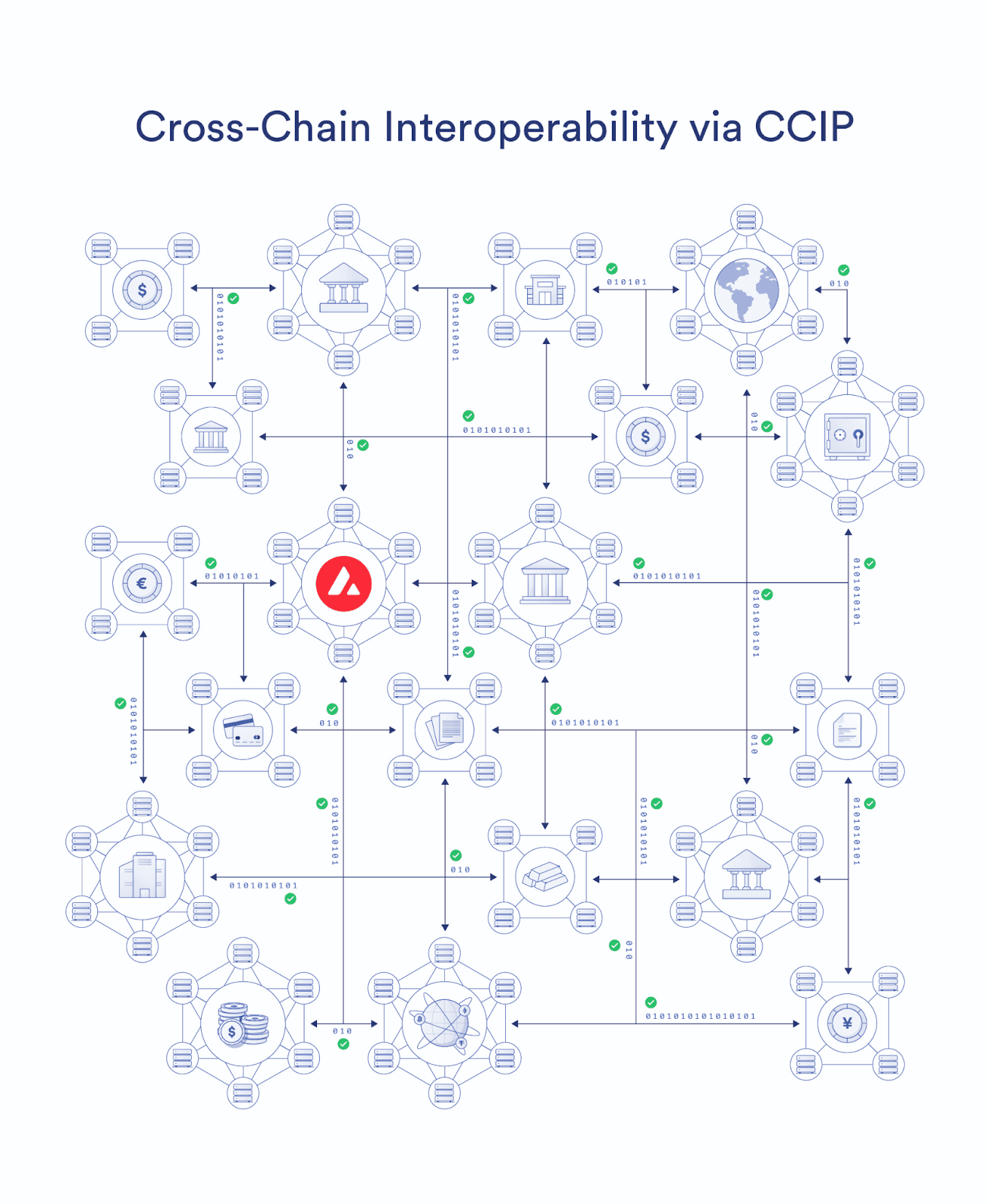

- Chainlink’s Cross-Chain Interoperability Protocol (CCIP) facilitates seamless asset movement and settlement across different networks and currencies.

- ANZ leverages its Digital Asset Services (DAS) portal and Avalanche Evergreen Subnet for efficient transaction initiation and settlement, showcasing the potential for blockchain-based solutions in traditional finance.

A recent SWIFT report highlights the growing belief among financial services leaders that blockchain, smart contracts, and tokenization can transform legacy capital markets infrastructure.

According to the report, 97% of institutional investors see tokenization as a game-changer for the asset management industry.

In line with this trend, Australia and New Zealand Banking Group (ANZ) and Chainlink Labs have joined forces to explore the global movement and settlement of tokenized assets across blockchains, notably Avalanche and Ethereum.

ANZ, serving over 8.5 million retail and institutional customers across nearly 30 markets, leveraged Chainlink’s Cross-Chain Interoperability Protocol (CCIP) to enable clients to access, trade, and settle tokenized assets seamlessly across different networks and currencies, employing a process known as Delivery vs. Payment (DvP).

DvP, a common standard for securities settlement, requires payment at or before asset delivery. Blockchain and smart contracts offer an opportunity to modernize DvP processes by tokenizing assets and payments on the same infrastructure, enabling atomic, non-intermediated settlement.

“Chainlink CCIP played a key role in abstracting away the blockchain complexity of moving tokenized assets across different chains and ensuring atomic cross-chain DvP,” said Lee Ross, Technology Domain Lead at ANZ.

The initiative simulated the purchase of tokenized assets on Ethereum and Avalanche, with ANZ facilitating transaction initiation and settlement using its Digital Asset Services (DAS) portal.

CCIP provided the backend infrastructure for seamless data transfer and token movement between Ethereum and Avalanche.

ANZ utilized its Avalanche Evergreen Subnet for its EVM compatibility and customized features, showcasing the potential for institutions to explore new use cases and business models in customizable blockchain environments.

“This ANZ project illustrates how traditional financial service providers are preparing for a new version of capital markets enhanced by blockchain,” said John Wu, President of Ava Labs.

“In these tests, ANZ is pioneering on-chain value transfer, while the infrastructure created by Chainlink and Avalanche offers interoperability and customizability for tokenized assets.”

These innovative efforts signify a significant step towards broader adoption of blockchain-based solutions in traditional finance, with promising results indicating potential future deployment on blockchain mainnets and expansion to include communication between different blockchain networks for various use cases.

For more Web3 news, check out the XGA newsfeed.