SEC Approves 11 Spot Bitcoin ETFs, Here’s How the Market Reacts

The long-awaited news is finally here. The Securities and Exchange Commission (SEC) has green-lighted 11 spot Bitcoin exchange-traded funds (ETFs) on Wednesday.

Notable names such as BlackRock’s iShares Bitcoin Trust, Grayscale Bitcoin Trust, and Fidelity Wise Origin Bitcoin Trust are included.

These ETFs will be divided across major exchanges, with six on the Chicago Board Options Exchange (CBOE), three on the New York Stock Exchange (NYSE), and two on Nasdaq.

The SEC has approved a spot Bitcoin ETF.@kaileyleinz reports https://t.co/8t3BXrEiXW pic.twitter.com/VksjHULlLf

— Bloomberg (@business) January 10, 2024

Bitcoin ETF Approval Coincides with Historic Tweet and Bulls Predictions

Interestingly, the approval date aligns with the historic tweet by @halfin, the first tweet ever mentioning Bitcoin on the X platform (previously Twitter) on January 10, 2009.

Running bitcoin

— halfin (@halfin) January 11, 2009

The development has sparked positive projections, with Bloomberg forecasting a staggering $4 billion in spot Bitcoin ETF inflows on the first trading day.

Earlier predictions from Standard Chartered and Fundstrat’s Thomas Lee suggest Bitcoin’s value could reach up to $200,000 in 2025 and $150,000 this year, respectively.

JUST IN: #Bitcoin price could hit $150K this year and up to $500,000 within 5 years - Tom Lee, Fundstrat pic.twitter.com/jQmNUoxLFm

— Bitcoin Archive (@BTC_Archive) January 10, 2024

Mixed Reactions and Warnings Amid Approval

While the approval is a major stride in cryptocurrency adoption, there are mixed reactions.

SEC Chairman Gery Gensler warned about associated risks, clarifying that the SEC did not endorse Bitcoin.

“While we approved the listing and trading of certain spot Bitcoin ETP shares today, we did not approve or endorse Bitcoin,” clarified him in the latest statement posted on the SEC’s official page.

JP Morgan CEO Jamie Dimon also dismissed Bitcoin’s value, citing concerns about illicit activities.

NEW: JP Morgan CEO Jamie Dimon says "#Bitcoin doesn't have value."

— Bitcoin Magazine (@BitcoinMagazine) January 10, 2024

Meanwhile, JP Morgan is an authorized participant for BlackRock's spot #Bitcoin ETF 👀 pic.twitter.com/W5MWONMOOE

In contrast, Bitwise commits to contributing 10% of spot Bitcoin ETF profits to open-source Bitcoin development, benefiting organizations like Brink, OpenSats, and the Human Rights Foundation’s Bitcoin Development Fund.

Bitwise will donate 10% of the profits of the Bitwise Bitcoin ETF (ticker: BITB) to bitcoin open-source development.

— Bitwise (@BitwiseInvest) January 10, 2024

Recipient orgs:

- @BitcoinBrink

- @OpenSats

- @HRF

Bitcoin is important to the future. We're excited for $BITB to support its foundation 👇 pic.twitter.com/JMzd4bMOB9

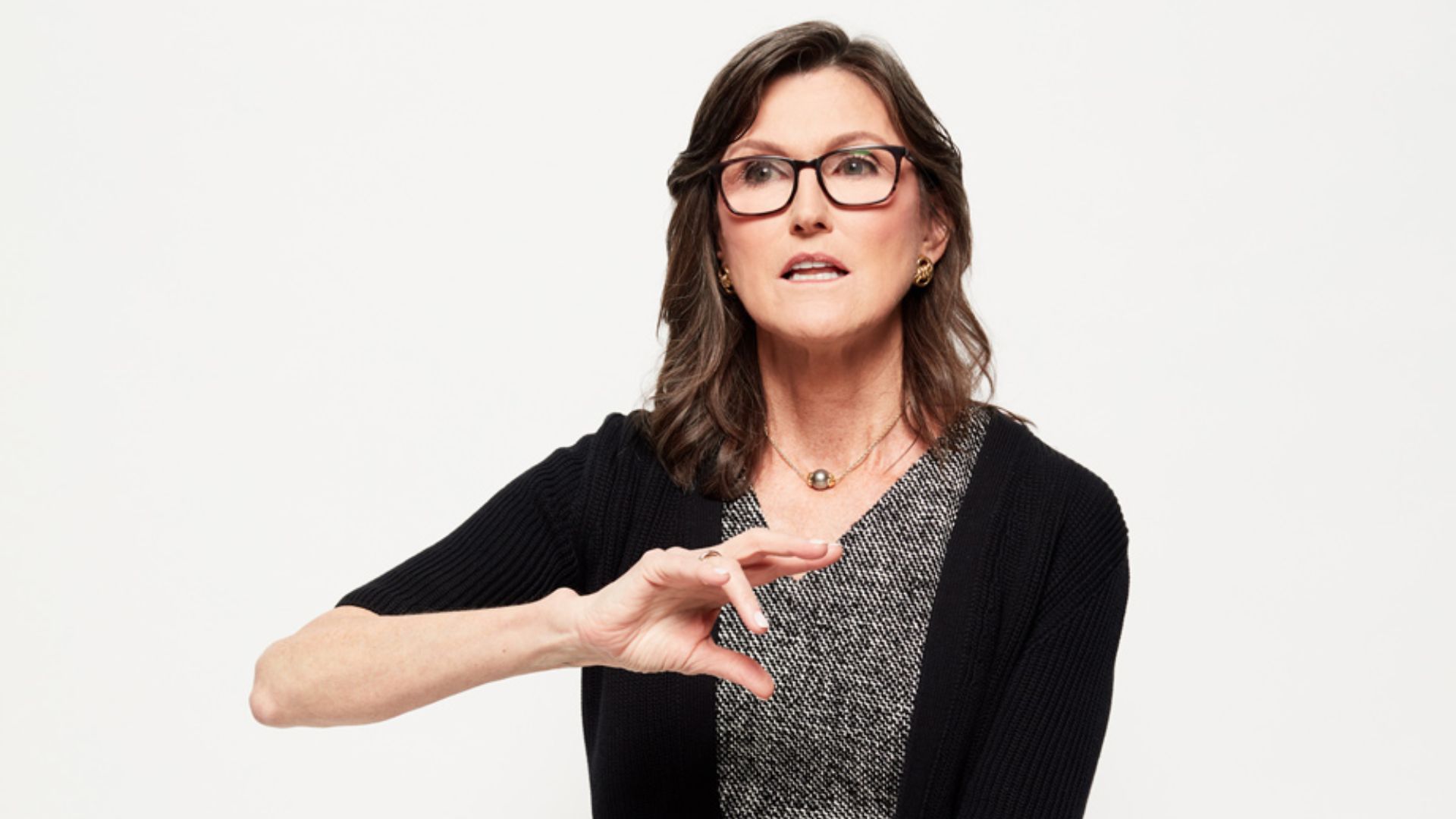

Meanwhile, ARK Investment Management‘s Cathie Wood expresses a broad interest, engaging with state pension funds and treasurers.

BlackRock’s spot Bitcoin ETF website has also promptly gone live, offering a simplified way for investors to gain exposure to Bitcoin’s price without the complexities of direct ownership.

Unlocking Bitcoin Access for All Investors

This significant development paves the way for a wide range of investors, spanning from pension funds to everyday individuals, to effortlessly enter the world of cryptocurrency.

Investors can now access Bitcoin’s price without the intricacies and risks of direct ownership through spot Bitcoin ETFs, eliminating the need for crypto wallets and exchanges’ security concerns.

In response to the news, the world’s oldest cryptocurrency also experienced a surge, reaching $46,160.48 and marking a 0.6% increase in the past 24 hours, as reported by CoinGecko (at the time of this writing).

For more Web3 news, check out the XGA newsfeed.